By now most swing voters in Manitoba have made up their minds to vote for somebody other than the NDP, and are reviewing their options among the remaining parties. If there are any non-diehard NDPers that are still leaning towards voting for the incumbents, it may be because they buy the NDP’s message that we need to spend money to stimulate jobs and growth. This blog post is for those folks.

Premier Greg Selinger’s mantra is that with the slow economy the government needs to stimulate growth and jobs through continued deficit spending. He has suggested that this is common sense, pointing to the new Liberal government in Ottawa as an example of great minds thinking alike.

The notion of using fiscal policy to influence the economy is 80 years old now, and over that time it has been hotly debated by economists. It is accepted that government spending increases the aggregate demand of the economy, as do other positive demand shocks like decreased taxes or increased investment. The questions are:

- when should stimulus be used, if at all?

- what type of stimulus should be used?

- what is the impact of the stimulus?

The father of fiscal policy, John Maynard Keynes, advocated strong deficit spending programs to alleviate the crushing unemployment of the Great Depression. During the Kennedy/Johnson era it was tax cuts that boosted the economy, not increased spending. Although both strategies have their place, they have not been universally successful each time they were implemented.

Keynes did not support deficit spending when the economy was growing, nor do most Keynsians who followed in his footsteps. In a normal rise-and-fall cycle, continuing the spending when the economy is growing can lead to damaging inflation and instability.

Our current situation is a little different. We are not in a normal cycle and inflation is not a big risk in the short term. What we have now is a slow growth plateau. Not declining growth, not a recession, but an extended period of slow growth. It is a new normal and something we need to adjust to, but when the provincial government spends more than it makes each year in this environment it is not the kind of stimulus spending that Keynes had in mind.

That is not to say that all spending is bad. Spending on strategic infrastructure can benefit the economy even if we’re not in a recession. It’s what some economists refer to as “government capital”, and if there’s a need for it then investing in it makes sense because it complements private investment.

If this is what distinguished the NDP from the other parties then they might have a point, except their record on investing on infrastructure is sketchy. They did not, for example, allocate the 1% PST hike to infrastructure like they promised, and they have not always spent what they had budgeted for hard infrastructure like roads and bridges. Meanwhile the PCs have also promised to spend at least $1 Billion each year on infrastructure, recognizing that there is some benefit to it.

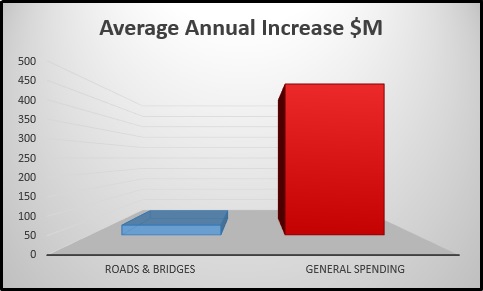

What really defines the NDP is their inability to control spending in health care and other departments. Over the past 5 years, spending on roads and bridges has increased $32 million per year on average while general spending has gone up an average of $490 million per year.

The increase in general spending has not only failed to produce results in terms of better service and outcomes but it has created a worrisome structural deficit and has nearly wiped out our fiscal stabilization fund. It is particularly worrying because the deficits aren’t planned — the NDP overspends its own budget virtually every year and often by a significant amount.

NDP supporters might tell you that the spending is worthwhile because every dollar spent generates additional economic activity. This is the famous multiplier effect — another concept introduced to the world by Keynes, although it was actually invented by his friend Richard Kahn. However not all government spending has the same multiplier. For example, building infrastructure is generally thought to have more of a benefit than, say, hiring a bureaucrat.

Moreover, with small economies like Manitoba much of the economic ripple effect spills beyond our borders and benefits other provinces and countries, because much of what an individual buys with their incremental income is manufactured and packaged elsewhere. It makes little sense for an entity the size of Manitoba to “stimulate” itself in an open economy unless it’s part of a larger Federal cost-shared program.

By all means, we should build roads, bridges and other infrastructure if we need it, but it makes little sense to spend money specifically to stimulate growth with an economy the size of Manitoba’s, especially when we’re not in a recession. It makes even less sense to try to stimulate the economy by increasing general government expenditures, which is not exactly what the NDP has been promising, but it is what the NDP has been doing.

Thanks for this blog post regarding stimulus spending; I really enjoyed it and am definitely recommending this blog to my friends and family. I’m a 15 year old with a blog on finance and economics at shreysfinanceblog.com, and would really appreciate it if you could read and comment on some of my articles, and perhaps follow, reblog and share some of my posts on social media. Thanks again for this fantastic post.